Bringing Tenancy Insurance In-House

Designed and launched a tenants’ insurance journey with The Lettings Hub, increasing policy submissions by over 250%.

The Problem

Renters were dropping off before completing their home insurance purchase. The education screens didn’t clearly explain the value of the product, and the redirect to a third-party site created friction and mistrust. The result: low conversions and a broken user experience.

The Solution

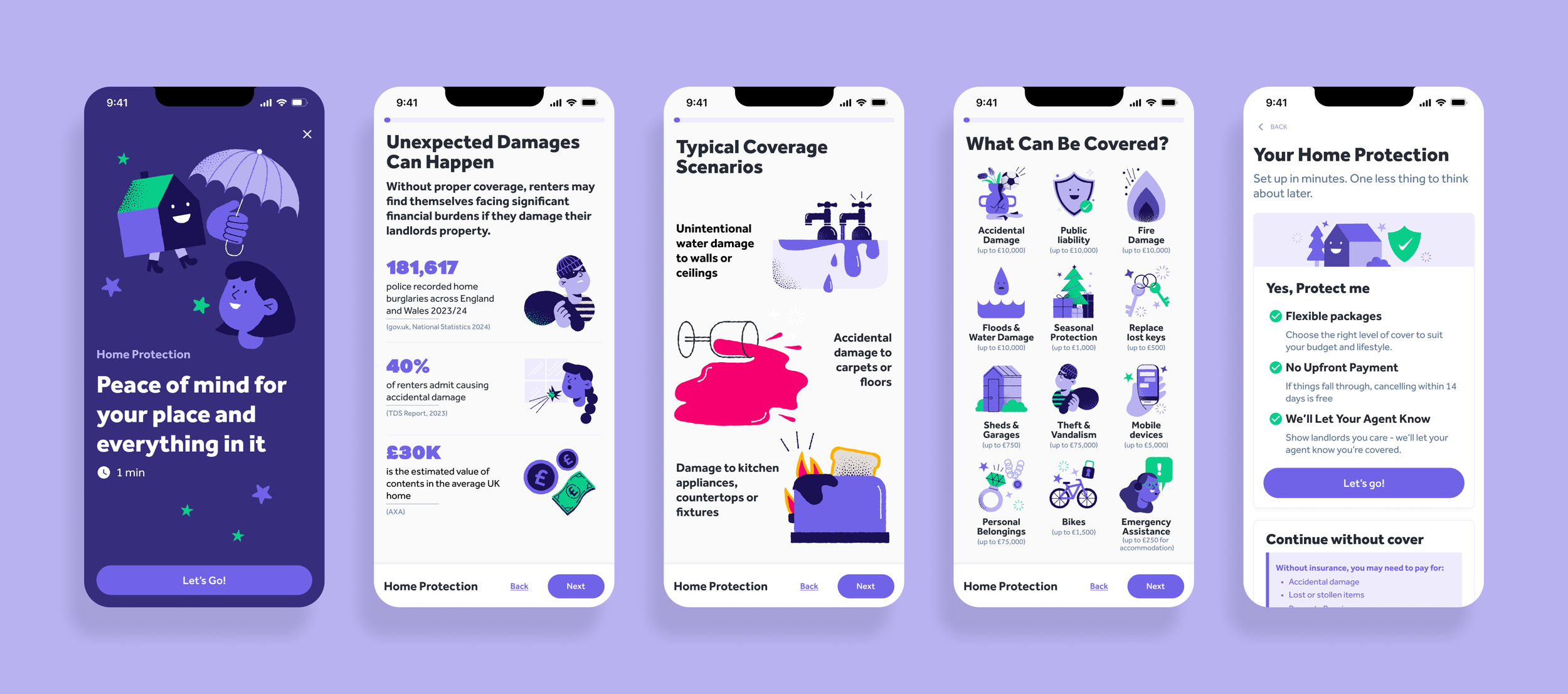

We redesigned the insurance journey directly within the Canopy app, removing external redirects and replacing them with a seamless, in-app purchase flow. To build trust and reduce friction, we introduced engaging visual storytelling and simplified policy explanations.

Alongside this, we closely monitored user behaviour at each stage of the funnel, using data to identify where drop-offs occurred and iterating based on those insights.

Testing part 1 – Education screens

Hypothesis: clearer, story-style education screens would help users understand coverage and build trust.

Method: A/B/C testing via pop-ups using Customer.io.

Result: Variant C (story style) had the highest engagement and became the foundation for the final design.

Testing part 2 - Opt-in flow

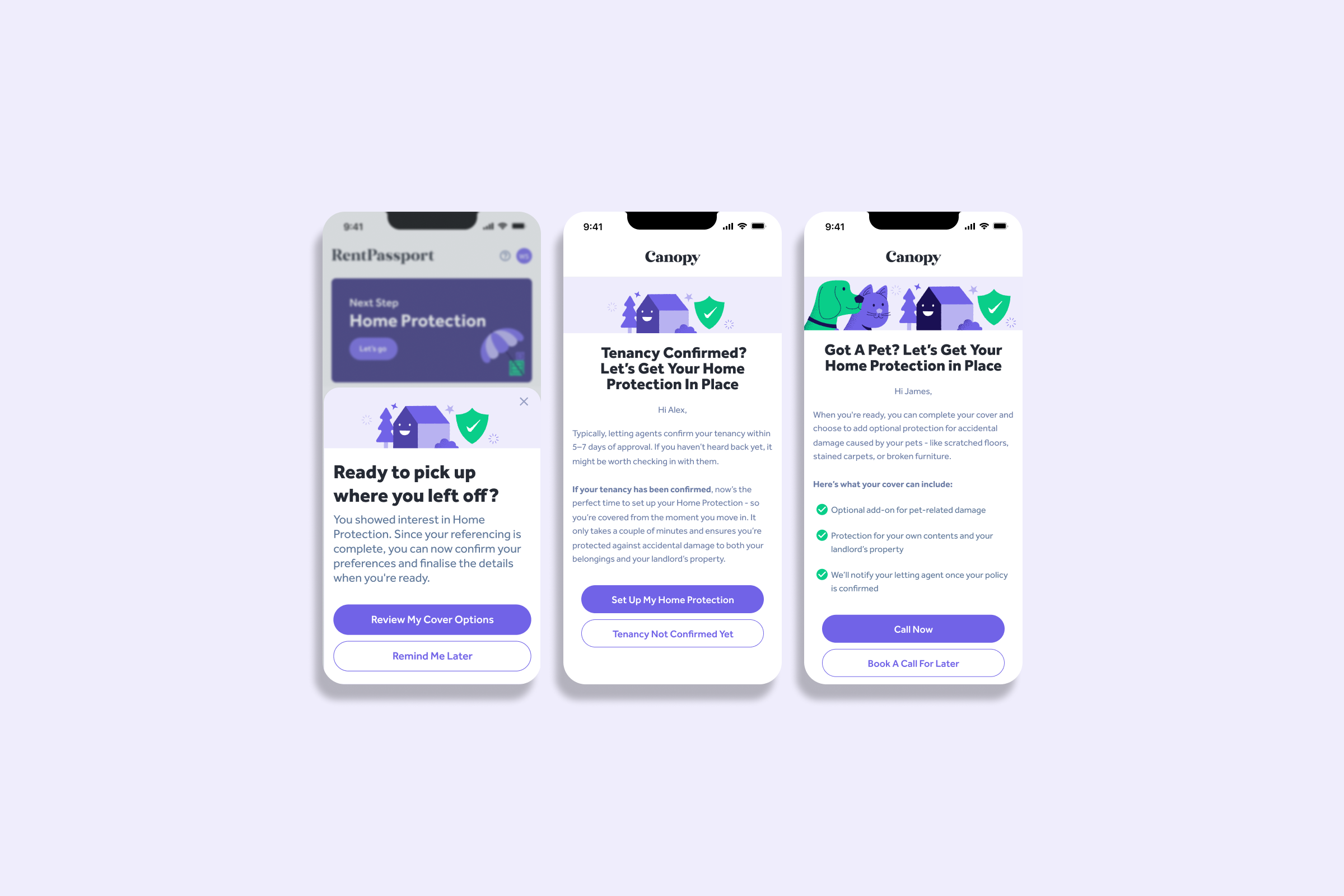

We tested variations in copy, CTA design, and reminder timing to optimise engagement. To re-engage users who delayed their purchase, we introduced follow-up touch points through both email and in-app campaigns. This approach successfully brought users back into the journey and boosted overall conversions.

The Outcome

+250% increase in policy purchases following the new journey.

Education screens improved trust and comprehension, helping users understand the value of coverage.

Streamlined flows reduced drop-off.

Around 40% of users still required custom quotes, exposing a gap in the digital product. This insight provided a measurable business case for further product evolution.